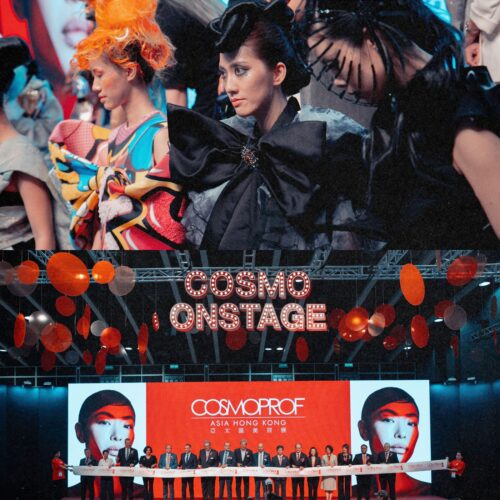

In the dynamic world of beauty, Korean products continue to command global attention, with recent trends highlighting a strategic evolution in their market focus. Despite expanding further into Western markets, Korea’s beauty industry remains deeply committed to China, leveraging cross-border e-commerce platforms to deliver innovative products that captivate Chinese consumers. The recent Cosmoprof Asia 2025 in Hong Kong—where Korean exhibitors dominated over 40% of the floor—served as a powerful testament to this ongoing influence and the growing global interest in K-beauty.

Source: Cosmoprof Asia 2025 Returns This November

Major Korean beauty corporations including Amorepacific, LG Household & Health Care, and Kolmar Korea have completed internal restructuring initiatives, accumulating momentum for their next growth phase through strategic measures such as streamlining distribution channels, increasing R&D investment, and strengthening global platform partnerships. Exhibiting brands collectively launched product series specifically designed for Chinese consumer preferences, demonstrating Korean companies’ clear strategic positioning of treating China as a core market.

Multiple innovative products emerging from the exhibition, including smart serums synchronized with menstrual cycles, micro-needle creams enhancing skin radiance and youthfulness, and diversified organic cosmetic lines, not only showcased Korean beauty’s R&D capabilities but also indicated future development directions in the Chinese market.

Source: Cosmoprof Asia 2025 Returns This November

Advanced Skincare Forms Korean Beauty’s Core Competitiveness

The skincare category consistently represents Korean brands’ core competitive advantage in entering the Chinese market. As Chinese consumers—particularly Gen Z and millennials—increasingly demand fast results, gentle formulations, and innovative ingredients, Korean beauty demonstrates significant strengths across all three dimensions.

Notable top-performing products within this category include: essences and ampoules containing effective ingredients like cica, snail mucin, and hyaluronic acid; functional cosmetic series integrating clinical research with natural ingredients; skin barrier repair products focusing on post-acne recovery and deep hydration; and anti-aging serums utilizing peptides, retinol alternatives, and fermentation technology.

The key factors behind Korean skincare’s success in the Chinese market lie in continuous R&D investment, visually appealing packaging designs optimized for social media dissemination, and the brand trust enhancement derived from Korean cultural influence. Brands represented by Laneige and Sulwhasoo maintain consistent popularity on Douyin through live commerce demonstrations showing real-time skincare effects, with their focus on hydration and anti-aging successfully attracting the 25-40 female demographic—China’s fastest-growing beauty consumer segment.

Sun Protection and Hybrid Solutions Become Fastest-Growing Segment

The daily sun protection category has emerged as the most rapidly expanding sector within China’s skincare market, a trend fueled by consumers’ persistent pursuit of anti-aging benefits and the “glass skin” aesthetic. Korean brands hold a distinct advantage in this field through their precise mastery of product texture.

Bestselling sun protection products include lightweight gel sunscreens, hybrid solutions combining skincare active ingredients with sun protection functions, tone-correcting sunscreens (such as lavender, peach, and green tints), and specially designed sun sticks for sensitive skin.

The success of Korean sun protection products stems from their deep understanding of Chinese consumers’ rejection of heavy, greasy formulas, coupled with lightweight texture technologies developed specifically for China’s humid climate. Market data reveals that posts tagged “Korean sunscreen recommendations” on Xiaohongshu garnered millions of views in 2024, fully reflecting strong market demand driven by key opinion leaders and user-generated content.

Scalp Care Opens New Frontier in Beauty Market

Scalp health management, as a relatively emerging category in China’s cross-border e-commerce market, is demonstrating robust growth momentum. This care culture, known as “head spa,” is significantly influenced by Korean personal care concepts.

Outstanding products in this category include scalp exfoliating scrubs, anti-hair loss serums, herbal formula shampoos, and salon-grade hair masks.

The rise of the scalp care category can be attributed to Chinese consumers’ heightened awareness of long-term scalp health management, younger demographics’ earlier attention to hair care, and the noticeable usage effects demonstrated by key opinion leaders on platforms like Douyin. Brands represented by Daeng Gi Meo Ri achieved remarkable sales growth through live commerce demonstrations showcasing the application process and visible results of traditional herbal formulations.

K-Makeup Wins Market with Natural, Photogenic Qualities

The color cosmetics category represents another crucial area where Korean brands demonstrate exceptional market performance, particularly through content creation by Douyin beauty influencers that widely disseminates K-beauty concepts.

The best-performing Korean color cosmetics products in the market include cushion foundations, glossy lip tints, soft-matte lipsticks, liquid blushes, and natural-style eyebrow pencils.

K-makeup’s success in the Chinese market originates from its strong alignment with the “clean girl aesthetic” popular on Xiaohongshu, with fresh, youthful formulations beloved by students and young professionals, while their visually appealing packaging designs perfectly suit social media content creation. Market trends indicate that lip tints and water-based blushes gained rapid popularity during Douyin’s 2024 “Korean girl makeup” trend, with multiple Korean brands experiencing sell-out situations during live streaming sessions.

Technology-Enabled Beauty Tools Show Sustained Demand Growth

Technology-driven beauty tools are increasingly becoming a focus for Chinese consumers, particularly repeat purchasers seeking more advanced skincare regimens. Korean brands have earned consumer trust in this area through technological integration and user experience optimization.

Top-performing Korean beauty tools in cross-border e-commerce channels include LED light therapy masks, ultrasonic cleansing devices, hot-cold alternating massage equipment, and portable home care devices.

This category’s growth momentum derives from Chinese consumers’ demand for professional devices delivering visible skincare results, along with these tools’ excellent compatibility with Korean essences and ampoules. With the growing popularity of at-home beauty care concepts, technology-enabled beauty tools are becoming a significant growth driver for Korean beauty in the Chinese market.

Korean Beauty Success Strategies Provide Lessons for International Brands

Korean beauty’s exceptional performance in the Chinese market is built upon three core principles: culture-driven brand storytelling, influencer-prioritized marketing strategies, and rapidly iterating product innovation cycles.

Korean cultural trends, television series, and lifestyle movements serve as natural brand amplifiers; Korean brands proactively established Douyin live commerce, key opinion leader, and key opinion consumer collaboration systems at an early stage; their product trends undergo complete renewal every 3-6 months, perfectly matching China’s fast-paced digital environment.

For beauty brands from Thailand, Indonesia, Australia, and Europe hoping to enter the Chinese market, applicable strategies include: developing product narratives aligned with local culture, partnering with appropriate Chinese key opinion leaders, establishing rapid product innovation mechanisms, and effectively utilizing digital platforms such as WeChat, Douyin, and Xiaohongshu.

MyMyPanda Empowers International Beauty Brands to Explore Chinese Market

Entering China’s beauty market requires comprehensive capabilities beyond products alone, as brands must simultaneously address logistics, cross-border e-commerce compliance, marketing, store operations, and customer experience challenges, while competing with established players for market share.

MyMyPanda provides global beauty brands with comprehensive localization support: professional China cross-border e-commerce operations and compliance services, including localized payment solutions, efficient customs clearance and tax processing, and bonded warehouse three-day express delivery; integrated marketing strategies covering Douyin, WeChat, and Xiaohongshu; local warehousing and logistics management; reliable cross-border fulfillment guarantees; and brand storytelling tailored to Chinese consumer insights.

Through the combination of deep local insights and end-to-end execution capabilities, MyMyPanda helps beauty brands establish sustainable business growth models in the Chinese market, rather than merely pursuing short-term viral successes.

Korean beauty brands have established industry benchmarks in China’s cross-border e-commerce sector through continuous innovation, powerful cultural influence, and agile response to digital trends. Recent Hong Kong Cosmoprof exhibitions and market data collectively indicate that Korean beauty enterprises are actively consolidating their competitive position in the Chinese market through deeper localization, accelerated product innovation, and digital transformation.

The successful trajectory of Korean beauty provides valuable experience for other international market participants. As China’s beauty market continues expanding into 2026, global brands that profoundly understand consumption trends and partner with strategic collaborators like MyMyPanda will hold the greatest potential to capture the next wave of growth opportunities in the Chinese market.