EXECUTIVE SUMMARY

China’s probiotics and gut-health market has entered a period of rapid premiumisation, driven by rising digestive discomfort, widespread antibiotic use, stress-induced gastrointestinal disorders, and growing consumer awareness of the microbiome.

Despite China’s large domestic manufacturing base, European probiotics are disproportionately trusted, associated with scientific credibility, quality control, clinical validation, and advanced strain technology.

At the same time, China’s domestic brands cluster around low-cost formats, lacking innovation in stabilisation technology, multi-strain synergies, targeted health formulations, and evidence-backed claims.

These dynamics combine to create a powerful opportunity for EU supplement & OTC manufacturers — one that aligns perfectly with Europe’s historical strengths in microbiome science, nutraceutical R&D, and quality standards.

This MyMyPanda report outlines the market landscape, consumer insights, regulatory pathways, competitive dynamics, and clear, actionable opportunities for EU exporters.

- MARKET LANDSCAPE & GROWTH OUTLOOK

Narrative Overview (HBR-style)

China’s probiotics sector has evolved from a novelty to a mainstream self-care category. The shift is driven less by fitness-oriented consumers and more by a rising public health problem: digestive discomfort is becoming a national trend, exacerbated by diet, lifestyle and antibiotic overuse.

In this environment, probiotics are no longer viewed as supplements — they are increasingly seen as functional health solutions. Consumers now look for formulations tailored to specific conditions, not general wellness.

Local manufacturers can serve the volume end of the market, but they struggle to satisfy the precision, quality, and clinical-proof expectations of China’s growing middle and upper-middle classes. This is where European exporters have a unique advantage.

Key forces shaping the category:

- Rapid expansion of self-care and preventive health

- A boom in science-driven consumer education via Douyin, Kuaishou, Xiaohongshu

- A significant rise in women’s health, paediatric gut health, and skin–gut axis interest

- Growth of cross-border e-commerce, enabling rapid introduction of foreign brands

- A demand shift toward premium and clinically validated formulations

China’s probiotics market is estimated in the double-digit billions (USD), with CAGR expectations ranging between 8–12%, depending on subcategory.

The trend is unmistakable:

China is becoming one of the world’s most dynamic gut-health markets — and one of the most import-receptive.

Actionable Insights for EU Exporters

Market Entry Priorities

- Focus on condition-specific probiotics rather than general health SKUs.

- Position your brand around science, evidence, and clinical outcomes.

- Enter through CBEC first, validate demand, then selectively expand offline.

Market Fit Requirements

- Multi-strain blends > single strain

- High CFU stability at room temperature

- Clear symptom-led messaging

- Professional endorsements (doctors, pharmacists, dietitians)

Growth Hotspots

- Women’s microbiome products

- Paediatric digestion & immunity

- Probiotics for skin health (acne, eczema)

- Stress, anxiety & gut–brain axis formulas

- Post-antibiotic and GI recovery SKUs

- CHINESE CONSUMER INSIGHTS & BEHAVIOUR

Narrative Overview (HBR-style)

Chinese consumers do not buy probiotics the way Europeans do. Their purchase behaviour is intensely outcome-driven and often influenced by KOLs, online reviews, and health bloggers.

Three psychological drivers define the category:

- Safety & Trust

China has experienced multiple supplement and infant-formula quality scandals over the years. As a result:

Imported = Safer

European = Most Trusted

This perception remains deeply rooted.

- Rapid Health Literacy Growth

Chinese consumers learn quickly. Unlike Western consumers who gradually absorb health information, Chinese consumers often “jump categories” based on:

- Douyin science explainer videos

- Doctor KOL recommendations

- Peer experiences shared online

This produces rapid adoption curves when a concept gains traction (e.g., microbiome, gut–skin axis).actiona

- A Shift Toward Personalised Solutions

Chinese consumers increasingly expect specific solutions (“probiotic for IBS”, “probiotic for skin clarity”, “children’s gut comfort”) rather than general digestive health products.

Europe’s tradition of precision strain selection maps perfectly onto this mindset.

Actionable Insights for EU Exporters

Consumer Messaging

- Focus on clear “benefit → mechanism → outcome” communication.

- Include micro-education inside packaging (strain science explained simply).

- Use symptom-led claims: bloating, irregularity, skin issues, child digestion.

Brand Positioning Tactics

- Emphasise European origin prominently.

- Highlight clinical studies, even small pilot studies.

- Use authority-building KOLs (pharmacists, dietitians).

Product Design Preferences

- Stick packs and capsules > powders-in-bags

- Mild flavours > strong dairy notes

- Portable and Instagrammable packaging

- QR-linked education content

- COMPETITIVE LANDSCAPE

Narrative Overview (HBR-style)

The competitive environment in China’s probiotics market can be thought of as a two-tier system:

Tier 1: Domestic High-Volume Players

Local manufacturers dominate the low-cost, low-science end of the market:

- Single-strain capsules

- Probiotic beverages

- Infant powders

- Basic digestion support

These brands compete heavily on price, convenience, and mass marketing, not science.

Tier 2: International Premium Players

This tier is dominated by:

- Japan (Bifido strains, paediatric solutions, gut–skin products)

- South Korea (beauty–probiotic hybrids, convenience formats)

- United States (clinical brands, high CFUs, condition-specific formulas)

- Australia (children’s health, immunity blends, natural positioning)

Europe under-indexes in presence, despite having:

- More clinical trials

- Higher strain sophistication

- More mature microbiome innovation

- Stronger regulatory credibility

This absence is not due to competitiveness — it is due to under-participation.

Actionable Insights for EU Exporters

Winning Differentiators

- Position as science-led — a clear gap in the market

- Offer microencapsulation, delayed-release, and stability technologies

- Promote European microbiome lab partnerships

- Create professional lines for pharmacies (higher credibility)

Category Gaps International Entrants Haven’t Filled

- European gut–skin axis brands

- Women-specific microbiome products

- Premium probiotics for seniors

- Probiotics combined with prebiotic fibre complexes

- Paediatric products with clear clinical backing

Competitive Threats to Watch

- Japanese players expanding through paediatric niches

- Korean beauty-supplement fusion brands

- China’s domestic brands accelerating innovation in strain science

- REGULATORY & CHANNEL LANDSCAPE

Narrative Overview (HBR-style)

China’s regulatory environment for dietary supplements is complex — but it is far more favourable to EU probiotic exporters than drug regulations.

Two main pathways define the market:

- Cross-Border E-Commerce (CBEC)

The fastest-growing and easiest route to market.

Products can be sold without full NMPA registration as long as:

- They are shipped from abroad into bonded warehouses

- Packaging meets CBEC rules

- Claims comply with “permitted e-commerce supplement claims”

CBEC has become a launchpad for nearly all Western supplement brands.

- Blue Hat Registration (for long-term offline expansion)

A more comprehensive process enabling:

- Offline retail

- Pharmacy sales

- Long-term brand building

- Institutional sales (clinics, health chains)

This pathway takes longer but is essential for brands aiming to scale.

Actionable Insights for EU Exporters

Channel Strategy

- Start with CBEC for fast market feedback.

- Use CBEC data to justify Blue Hat registration later.

- Build presence on: RedNote first, followed by: Tmall Global, JD Worldwide, Xiaohongshu, Douyin.

Regulatory Best Practices

- Avoid medicinal claims (“treat”, “cure”). Use functional claims.

- Provide transparent documentation of strain origin & safety.

- Prepare to adjust EU claims to China’s approved claim categories.

Operational Considerations

- Work with local CBEC partners for logistics & compliance.

- Localise packaging (Mandarin inserts, QR codes).

- Implement social listening tools for real-time sentiment tracking.

- OPPORTUNITY MAPPING FOR EU EXPORTERS

Narrative Overview (HBR-style)

China’s probiotics market is not just large — it is diverse, fragmented, and deeply influenced by consumer psychology.

The biggest opportunities lie in mature but underserved niches, where:

- Domestic brands lack sophistication

- Japanese/Korean brands are strong but not dominant

- US brands are present but expensive

- EU science provides a unique competitive angle

By aligning product innovation with China’s consumer needs, EU brands can command premium margins and build defensible market positions.

Highest-Priority Opportunities (Action List)

- Women’s Microbiome Health

Key SKUs: vaginal flora support, UTI prevention, intimate microbiome balancing.

Why EU wins: strong clinical backing, safety trust.

- Paediatric Probiotics

Key SKUs: digestion relief, immunity blends, colic formulations.

Why EU wins: safety perception + decades of paediatric research.

- Gut–Skin Axis Probiotics

Key SKUs: acne support, eczema balancing, barrier repair.

Why EU wins: EU dermo-cosmetic leadership + strong microbiome science.

- IBS & Digestive Comfort Solutions

Key SKUs: anti-bloat, anti-gas, bowel regularity, FODMAP-friendly strains.

Why EU wins: advanced clinical trials, strain-specific outcomes.

- Stress & Gut–Brain Axis Formulas

Key SKUs: mood support, sleep improvement, anxiety reduction.

Why EU wins: innovation in botanical + probiotic blends.

- Active Senior Health Probiotics

Key SKUs: immunity, digestion, cognitive links.

Why EU wins: ageing population + lack of local senior-focused SKUs.

- RECOMMENDED ENTRY STRATEGY FOR EU MANUFACTURERS

Narrative Overview (HBR-style)

The Chinese market rewards speed, science, and storytelling.

EU brands entering China need a strategy that blends clinical credibility, category focus, and digital channel mastery.

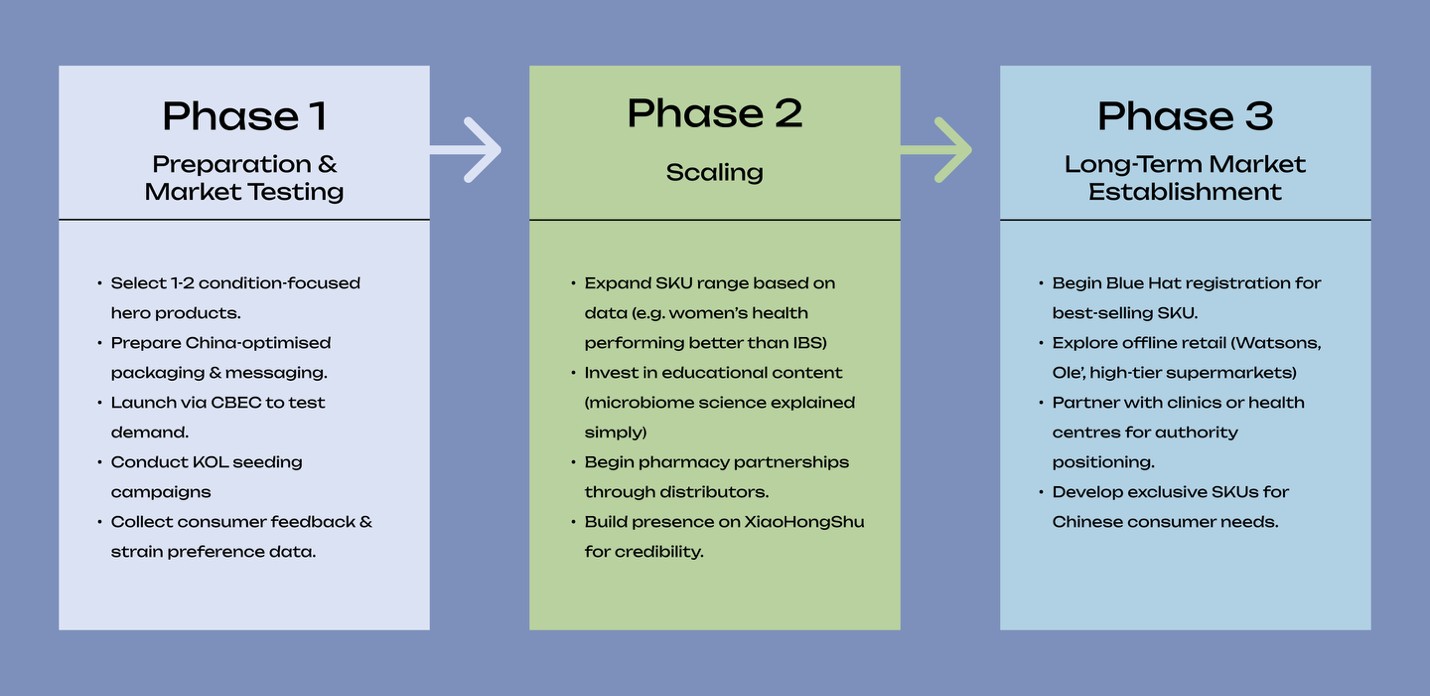

Step-by-Step Action Framework

PHASE 1 — Preparation & Market Testing

- Select 1–2 condition-focused hero products

- Prepare China-optimised packaging & messaging

- Launch via CBEC to test demand

- Conduct KOL seeding campaigns

- Collect consumer feedback & strain preference data

PHASE 2 — Scaling

- Expand SKU range based on data (e.g., women’s health performing better than IBS)

- Invest in educational content (microbiome science explained simply)

- Begin pharmacy partnerships through distributors

- Build presence on Xiaohongshu for credibility

PHASE 3 — Long-Term Market Establishment

- Begin Blue Hat registration for best-selling SKU

- Explore offline retail (Watsons, Ole’, high-tier supermarkets)

- Partner with clinics or health centres for authority positioning

- Develop exclusive SKUs for Chinese consumer needs

- FINAL RECOMMENDATIONS

Strategic Priorities for EU Exporters

- Lead with science, not lifestyle branding

- Focus on targeted outcomes, not general gut health

- Use CBEC for low-risk validation

- Prioritise women’s health, paediatric, gut–skin axis, IBS and gut–brain solutions

- Invest in Chinese-language educational content

- Build long-term credibility through clinical transparency

China’s probiotics market rewards brands that deliver precision, safety, and real-world outcomes — areas where EU manufacturers naturally excel.

CONCLUSION

China is not just another export market — it is becoming the global epicentre of gut-health consumer innovation.

European supplement and OTC companies have the scientific depth, manufacturing quality, and strain technology that Chinese consumers actively seek but cannot easily find locally.

The opportunity is clear:

Europe can lead China’s premium probiotics sector — if it enters with focus, clinical credibility, and a consumer-driven strategy.

This full intelligence report from MyMyPanda outlines exactly how.