One consensus reigns supreme in global commerce: China’s e-commerce ecosystem evolves at a pace unmatched anywhere else. Trends that dominate today can fade into irrelevance within months, while emerging platforms can rapidly ascend to industry dominance.

As we approach 2026, the Chinese digital retail landscape is undergoing another profound shift. For international brands eyeing the cross-border e-commerce (CBEC) market, adapting to these changes is no longer a strategic advantage—it’s fundamental to survival.

Here is a practical, in-depth breakdown of the critical trends your brand needs to strategize for now.

Trend 1: Douyin Is Solidifying Its Role as the “Everything Store”

Gone are the days when Douyin was merely a short-video platform. By 2026, Douyin has fully matured into a multifaceted commercial powerhouse, seamlessly integrating the functions of a marketplace, search engine, livestream shopping hub, product discovery tool, and brand-building ecosystem. Notably, more consumers now initiate their product research on Douyin than on traditional giants like Tmall. For new market entrants, Douyin offers the most effective launchpad—not through costly celebrity KOLs, but via authentic micro-KOCs, engaging short videos, and demonstrative content.

Actionable Insight for Foreign Brands:

- Develop a library of short, genuine, and culturally localized product videos.

- Prioritize collaborations with relatable micro-KOCs over expensive top-tier influencers.

- stablish a dedicated presence within Douyin’s e-commerce ecosystem from the outset. Without visibility on Douyin, your brand risks being perceived as non-existent by the modern Chinese consumer.

Trend 2: The Dominance of “Interest-Based E-Commerce” Over Traditional Search

The classic model of “search-and-buy” is being superseded by the “discover-and-buy” paradigm. Chinese consumers in 2026 are increasingly guided by sophisticated algorithms that push products based on their interests and online behavior. This shift means that compelling explainer videos and immersive “scenario storytelling” consistently outperform static advertisements and simple product listings.

Illustrative Example:

Source: https://www.digitaling.com/articles/761452.html

The French brand L’Oréal collaborated with Douyin to launch the “Little Honey Pot Versailles Limited Edition” product and initiated the hashtag challenge #YouDeserveVersailles. During the campaign, celebrities highlighted the product’s French luxury attributes through creative costume change short videos, while musicians released a custom theme song to enhance the brand’s premium appeal and emotional resonance, attracting a large number of users to participate in secondary creations. The total video views under the topic exceeded 19.3 million, and the GMV on the first day of the campaign surpassed 19 million yuan.

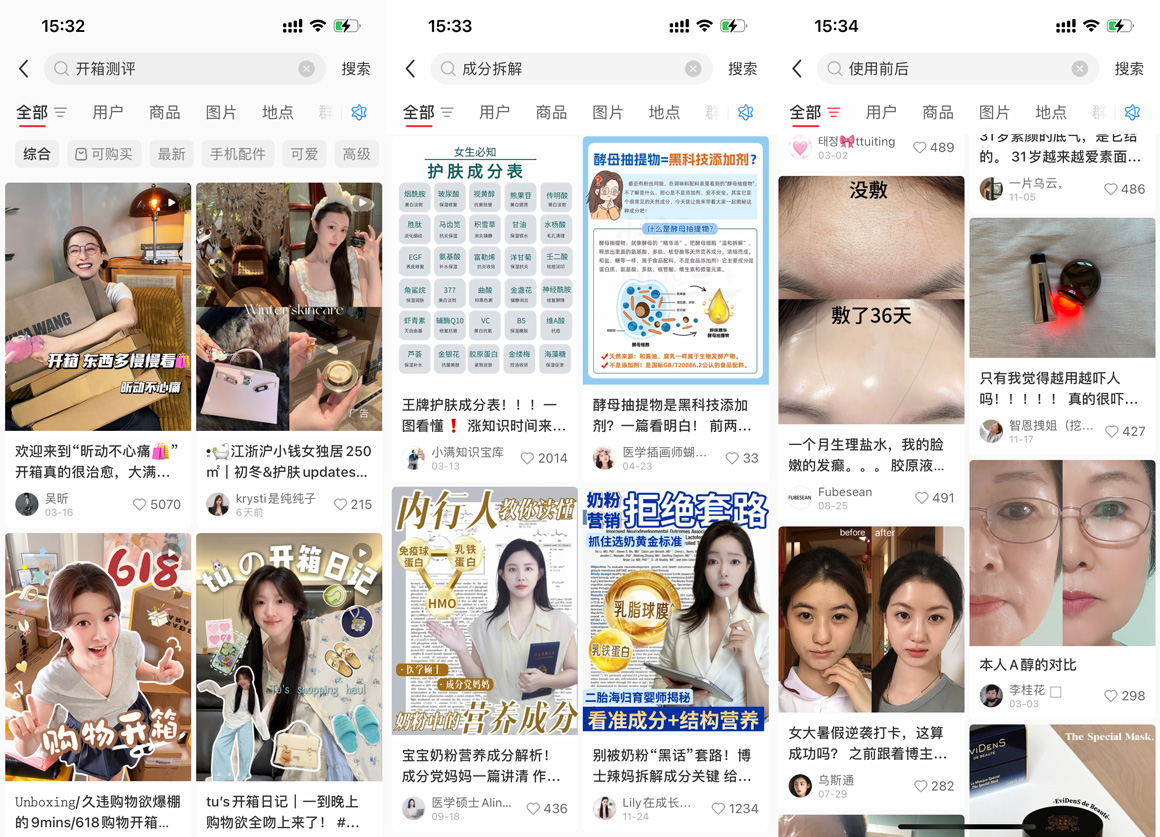

Trend 3: RedNote as the Trust Engine for Gen Z & Female Shoppers

If Douyin is the engine of impulse, RedNote is the cornerstone of credibility. Younger Chinese consumers place immense trust in authentic user-generated content, meticulously scouring the platform for unboxing posts, detailed ingredient analyses, before-and-after visuals, and honest user diaries. Its influence is particularly potent in the beauty, wellness, fashion, lifestyle, and premium imported goods sectors. By 2026, a brand without a substantive presence on RedNote will be viewed with skepticism.

Actionable Insight for Foreign Brands:

- Focus on accumulating 50–200 genuine micro-reviews from real users.

- Create lifestyle-oriented content that resonates with local tastes and preferences.

- Adopt a “soft recommendation” approach, providing value-driven advice rather than blunt promotional messages.

Trend 4: Social Commerce Takes Precedence Over Traditional E-Commerce

Shopping in China has transcended a mere transaction; it is now a form of entertainment, community engagement, and identity expression. Platforms like Douyin, RedNote, Kuaishou, and WeChat Channels have become the primary venues for product discovery, often eclipsing traditional marketplaces.

The Strategic Implication:

The outdated mindset of “We need Tmall Global” must be updated. The 2026 reality is “We need a social-first commerce strategy before we consider Tmall.” Building brand buzz and a community on social platforms is a prerequisite for surviving the intense competition and high advertising costs on major marketplaces.

Trend 5: The Strategic Imperative of Private Traffic

In China, “private traffic” refers to the owned audience channels that a brand controls directly, insulating it from platform algorithm changes. This ecosystem includes WeChat groups, exclusive VIP communities, mini-programs, brand newsletters, and member-only offers. As paid advertising costs soar and social media algorithms remain in constant flux, cultivating private traffic via WeChat has become a critical strategy for sustainable growth and customer retention.

Actionable Insight for Foreign Brands:

- Develop a clear pathway to transform one-time buyers into loyal followers.

- Implement a structured community management strategy for customer groups.

- Establish a post-purchase engagement system to foster long-term relationships.

Trend 6: CBEC Logistics: The New Bar is Speed + Hyper-Localization

Consumer expectations in China are higher than ever: they demand faster delivery (often within 48 hours), superior and localized packaging, transparent return policies, low or free shipping, and responsive local customer support. The sophisticated network of bonded warehouses makes this possible, but only for brands that partner with a fulfillment expert.

In 2026, the CBEC winners will not necessarily be the largest brands, but those that master operational excellence through 48-hour delivery, China-friendly packaging, hassle-free returns, and exceptional customer service. This is where a specialized partner proves invaluable.

Trend 7: Ingredient Transparency & Storytelling Trump Pure Brand Power

The 2026 Chinese consumer is highly informed and discerning. They prioritize concrete proof points: ingredient safety, clinical evidence, certifications, product origin, sustainability, and suitability for sensitive skin. While a compelling brand story is important, it must be built upon a foundation of undeniable product truth.

A beauty brand from France, Switzerland, Thailand, or Australia that meticulously explains its formula’s efficacy, testing protocols, and tangible results will often win over customers from even the most established global giants.

Trend 8: The Era of “Niche Brands, Major Impact”

The notion that consumers only trust household names is obsolete. Today, Chinese shoppers actively seek out high-quality, specialized brands that cater to specific needs. Nimble, niche labels are now leading categories like clean beauty, baby products, supplements, haircare, fragrances, sunscreens, and snacks. This is because purchase decisions are increasingly driven by algorithmic recommendations of well-reviewed products, not just global fame. This paradigm shift presents a monumental opportunity for foreign SMEs to enter the market via CBEC.

Strategic Shifts for Global Brands Entering China in 2026

To succeed, a fundamental mindset shift is required:

- Move away from global marketing templates; embrace China-native content creation.

- Shift budget from big influencers to authentic, relatable micro-creators.

- Replace long, rigid campaigns with agile, fast-paced content testing.

- bandon a “brand-first” mentality; adopt a “consumer-first” obsession.

- Stop thinking like a Western corporation; start understanding the world through the eyes of a Chinese shopper.

Why MyMyPanda is Your Essential Partner for 2026

Navigating this complex, fast-changing landscape alone is a formidable challenge. Success requires a local partner with deep expertise who not only understands trends but executes on them. MyMyPanda provides an integrated solution, offering services in trend analysis, bonded warehouse fulfillment, customs and compliance, KOL/KOC data tracking, CBEC store strategy, cultural content localization, platform algorithm monitoring, and ongoing weekly optimization.

We empower international brands to enter China correctly, scale sustainably, build authentic trust on local platforms, achieve growth without wasted budget, and adapt with agility to the next wave of trends. In China’s dynamic market, flawless execution will always outweigh theoretical knowledge.

Conclusion

The year 2026 is poised to be a transformative period for China’s e-commerce ecosystem. With platforms continuously evolving, consumer behaviors shifting, and competition becoming increasingly algorithm-driven, the stakes have never been higher. Foreign brands that proactively understand and integrate these trends into their core strategy will find immense opportunities for growth. Those that delay risk being left behind. With the right CBEC strategy, resonant content, and an expert local partner like MyMyPanda, the potential for success in the China market is greater than ever before.