Sold Out in 14 Days, 300% Growth in 90 Days: How European Beauty Brands Are Cracking the China Market Code

When walking through a beauty store in China, whether a physical retailer or an online platform like Tmall Global, Douyin, or RedNote, one observation becomes immediately clear: Chinese consumers have a pronounced affinity for European beauty brands. Among them, French, Swiss, and Spanish brands have secured a particularly distinguished position. They are more than just products; they have become symbols of quality, craftsmanship, and trust.

But what exactly enables brands from these three countries to stand out so markedly within China’s competitive cross-border e-commerce landscape?

I. European Beauty: The Foundation of Trust

Today’s Chinese consumers are highly informed. They routinely compare ingredients, watch product reviews, follow Key Opinion Leaders (KOLs), and delve into professional analyses. They are willing to pay a premium for products that genuinely deliver a high-quality experience.

The exceptional performance of European beauty rests on three pillars of consensus: First, France, Switzerland, and Spain are all viewed as “beauty sanctuaries” with skincare traditions spanning decades, if not centuries. Second, Europe’s stringent safety standards are among the most rigorous globally, a critical factor for Chinese buyers seeking safe, clean, and reliably formulated products. Third, products originating from Paris, Geneva, or Barcelona carry an inherent prestige and quality halo that resonates with consumers even before they physically interact with the item.

II. French Brands: The Synergy of Elegance and Science

France is widely regarded as the world’s capital of beauty. Chinese consumers perceive French brands as synonymous with elegance, luxury, professionalism, and proven efficacy. They are described as offering “high-end skincare with effective formulas,” “trustworthy, scientifically-backed ingredients,” and an embodiment of a “luxury lifestyle.” Popular categories include anti-aging serums, premium moisturizers, perfumes, foundation makeup, and products for sensitive skin.

Source: https://caijing.chinadaily.com.cn/a/202302/09/WS63e4856ca3102ada8b22e539.html

French brands master not only elegance, but also the art of cultural localization—and the results are measurable. Guerlain’s Lunar New Year campaign perfectly demonstrates this: the brand merged its iconic orchid motif with the Chinese cultural symbol of “good fortune,” creating a limited “Red Luck” collection that blends French sophistication with Eastern tradition. During Douyin’s Super Brand Day, Guerlain leveraged celebrity livestreams, influencer seeding, and viral dance challenges to drive exceptional engagement and sales. When top influencer @马帅归来 hosted the brand’s first major livestream专场, the signature perfume sold out within just five minutes, propelling the broadcast to #1 on Douyin’s “精致丽人” beauty sales ranking. Meanwhile, the hashtag #赵露思直播跳手势舞# from brand ambassador Zhao Lusi’s live session trended beyond Douyin, reaching the Top 13 on Weibo’s hot search list. By combining heritage elegance with locally resonant, emotionally smart marketing, French brands continue to capture both the attention and spending power of Chinese consumers.

III. Swiss Brands: The Natural Credibility of Pure Luxury

In the Chinese market, Swiss beauty is almost synonymous with “pure luxury.” Consumers naturally associate Switzerland with pure ingredients, precision research, and stringent standards. Even with premium pricing, Chinese consumers view this as a guarantee of quality and incorporate it into their expectations for high-end consumption.

Source: https://www.sohu.com/a/343825853_120170465

Anti-aging creams, brightening serums, and cutting-edge anti-aging products are the standout categories for Swiss brands. The growth trajectory of the high-end brand Cellcosmet serves as a clear example. The brand has concretized its “Swiss luxury” gene into a unique “live cell anti-aging” technology, clearly labeling active ingredient concentrations to transparently and verifiably transform the national perception of “Swiss precision research” into tangible product promises. At the same time, through endorsements by credible celebrities like Sun Li, the brand has amassed a wealth of in-depth user shares and professional analyses on platforms such as RedNote, combining cutting-edge technology with authentic word-of-mouth. This perfectly illustrates the success logic of Swiss brands: they elevate the trust in “pure and natural” origins into a perceptible “luxury efficacy” backed by advanced biotechnology, making consumers willingly pay a premium for this “scientific gift” from Swiss laboratories.

IV. Spanish Brands: The Rise of Practical Professionalism

Over the past three to four years, Spanish skincare has quietly surged in popularity in China. Its appeal lies in a compelling mix of high quality, accessible pricing, gentle formulas, and dermatological endorsements. Spain’s strong reputation in sun care and skin repair perfectly aligns with growing consumer demand in these categories.

Source: https://www.163.com/dy/article/G7E975I7051993MA.html

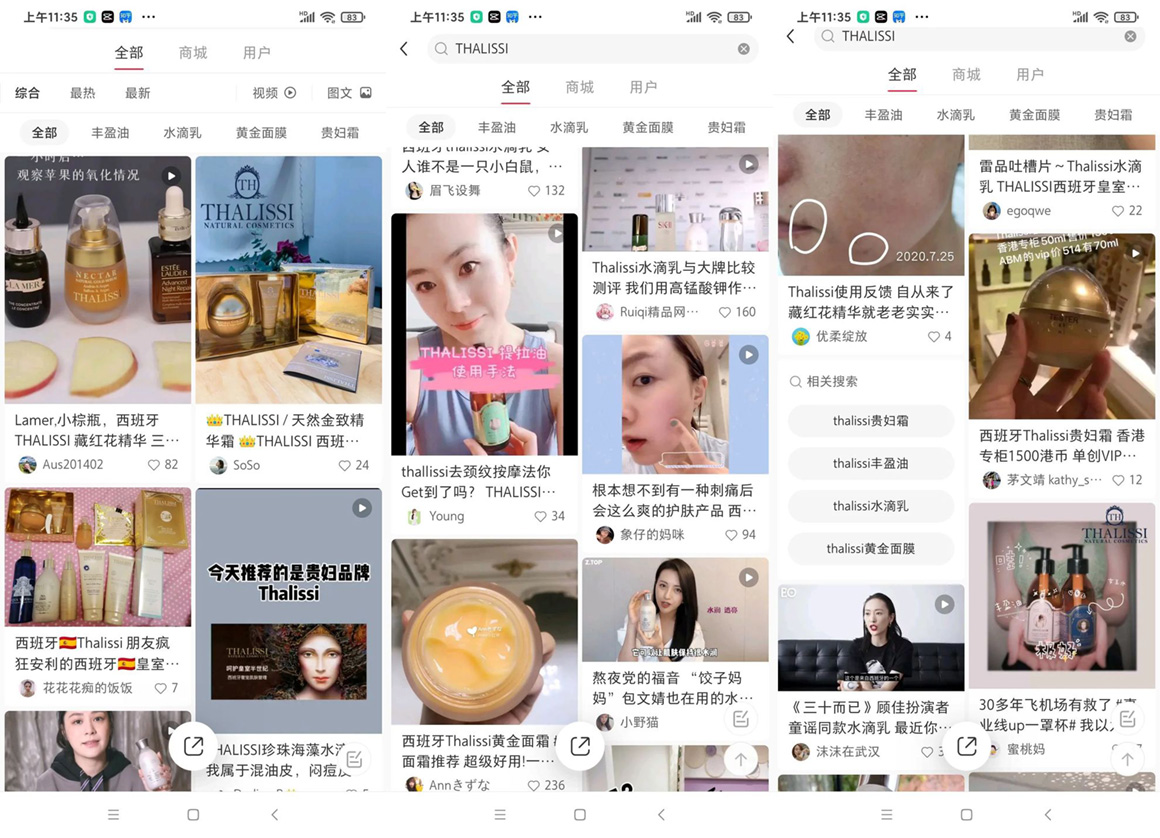

The development journey of the heritage Spanish brand THALISSI serves as a representative example. Founded in 1969, the brand carries forward the skincare traditions of the Spanish royal family, adhering to safe, gentle, and natural ingredients while rejecting harmful chemical additives. Upon entering the Chinese market, THALISSI did not position itself primarily around “luxury.” Instead, it highlighted its half-century of research heritage and dermatological background, consistently communicating its pragmatic image as a “professional, clinic-grade skincare” brand through platforms like Xiaohongshu. This strategy of transforming “royal beauty secrets” into “accessible professional skincare solutions” has allowed the brand to carve out a differentiated positioning among numerous high-end skincare competitors.

V. The Common Code to Success

At a deeper level, the sustained success of French, Swiss, and Spanish beauty brands in China rests on three consumer psychology fundamentals: First, there is innate trust in the beauty R&D ecosystems, historical legacy, and production standards of these countries. Second, products convey a premium feel through packaging, branding, and national image before they even reach the user. Finally, their brand storytelling deeply resonates with the Chinese consumer sentiment, which values narratives around laboratories, science, purity, ingredients, nature, and research.

The three countries have distinct positioning: France represents “Luxury and Art,” Switzerland symbolizes “Purity and Science,” and Spain champions “Dermatology and Practicality,” each precisely targeting different consumer need segments.

VI. Winning in the Cross-Border Ecosystem

Across China’s diverse cross-border e-commerce channels, these European brands achieve excellence through tailored approaches: On Douyin, short product demonstrations coupled with country-of-origin storytelling enable rapid conversion. On RedNote, European skincare is highly praised in user reviews for its ingredient transparency. On Tmall Global, official flagship stores leverage brand authority and member management to foster strong repeat purchase rates. In KOL and KOC (Key Opinion Consumer) marketing, European brands are favored by content creators for being “premium yet accessible.”

VII. Future Outlook: Strategy is Paramount

The opportunity for European beauty brands in China is far from exhausted. However, success depends not only on the product itself but also on a market entry strategy that is precisely calibrated. This includes compliance with cross-border e-commerce regulations, utilizing bonded warehouse fulfillment, understanding local content culture, aligning messaging with Chinese consumer preferences, and selecting the right KOL partners and primary marketing platforms.

This is precisely where MyMyPanda delivers value. We are dedicated to helping international brands localize their storytelling, create platform-native content, manage KOC and livestreaming resources, optimize cross-border store operations, handle logistics, fulfillment, and compliance, and track trends in real-time to refine strategy. In essence, we assist global brands in translating their core strengths into a language that resonates with and captivates Chinese consumers.

Conclusion

The enduring shine of French, Swiss, and Spanish beauty brands in China is fueled not only by the potency of their product formulations but also by the profound trust inspired by their countries of origin. The heritage, standards, and beauty philosophies they carry align perfectly with the expectations of modern Chinese consumers.

With a scientifically sound cross-border framework and a localized content strategy, these brands possess the potential to rapidly transform from “overseas niche secrets” into “trending must-haves in China.” MyMyPanda is ready to partner with brands to turn this potential into a tangible, sustainable growth pathway.