- What are the types of China cross-border tax?

- Does the Chinese government have any tax incentives for cross-border shipping?

- Which cross-border shipping mode is better for my business?

- How can I ship my goods to China at low cost?

- How to calculate the tax rate for cross-border ecommerce in China?

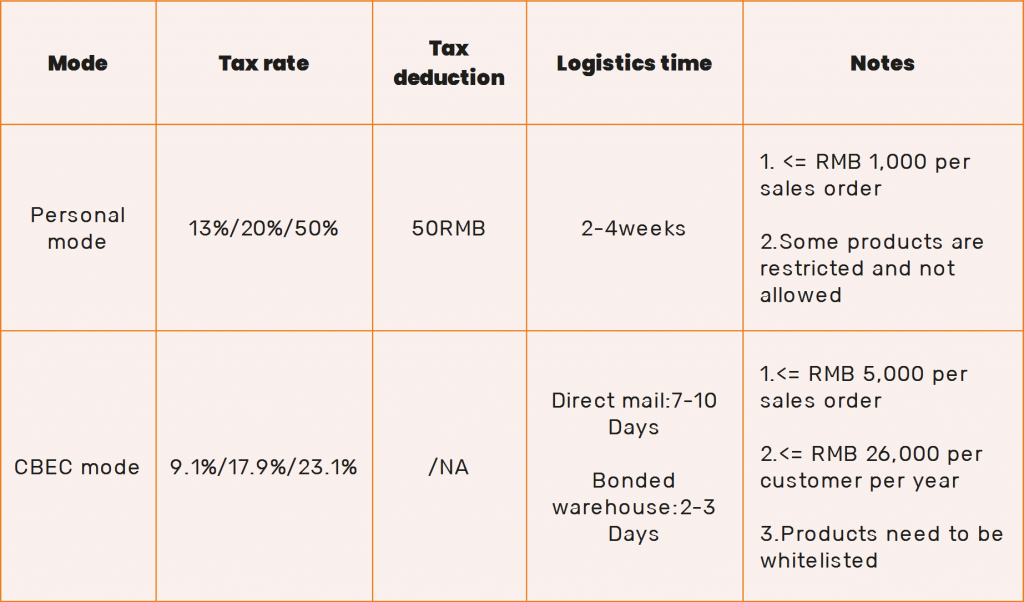

At present, there are two common methods for China cross-border tax, each shipping method will involve different customs regulation and tax:

1. Personal Shipping Mode

Personal shipping mode is officially a C2C method to deliver goods to China by postal package (e.g. EMS/UPU). The advantages of this mode are:

- The Chinese customs only collects import duties;

- If the import tax for a package is less than 50 RMB (US$8), the Chinese customs will not impose any tax on the package;

- Although the customs randomly checks on packages to ensure they are taxed, not every package needs to pay taxes;

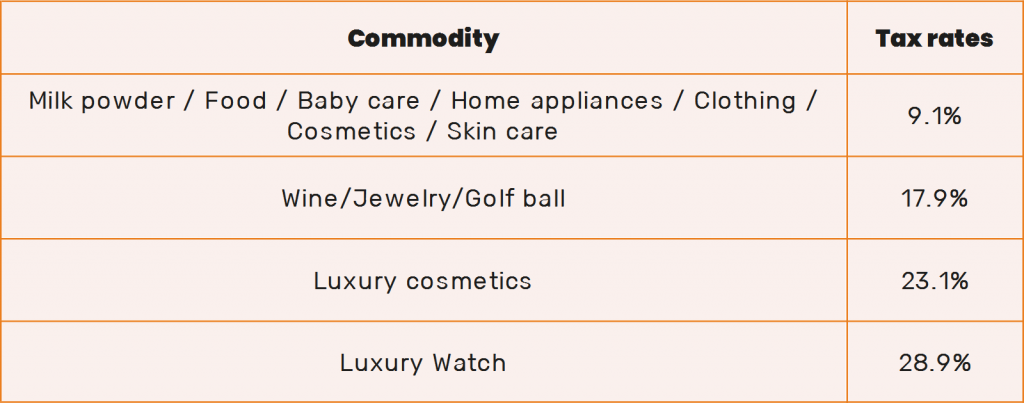

Import tax calculation:

Import tax = duty paid price * tax rate

Tax rates for common commodities:

Since this is not an official business method for cross-border shipping, it is not suitable for brands to use this channel. On top of that, if you have high order numbers, the likelihood of Chinese customs intercepting your packages will also be higher. This means when a package is found not complying to China customs and tax regulations, the customer will be penalized either by paying the necessary high tax or risk products being returned to sender.

2. Cross-Border E-Commerce (CBEC) Shipping Mode

In recent years, China’s cross-border e-commerce is booming, and the Chinese government is encouraging businesses to use CBEC as the official channel for selling and shipping to China. Indeed, China Customs released a new China tax policy in 2019 and stated the followings:

- The maximum value of a single order has increased from RMB2,000 (US$700) to RMB5,000 (US$700)

- The maximum annual purchase amount for consumers has increased from RMB20,000 (US$2800) to RMB26,000 (US$3635);

Not only has the transaction amount increased, but the Chinese government also gave some preferential policies in terms of taxes. For instance, if the order amount is less than RMB5,000 and does not exceed the annual limit for consumers (RMB26,000), then the goods will be exempted from import tax. VAT and consumption tax will be given a 30% discount!

CBEC tax rate calculation method:

CBEC tax rate = [(VAT rate + consumption tax rate) / (1 – consumption tax rate)]*70%

CBEC tax rates for common commodities:

Since the introduction of new customs policy, the CBEC tax on many goods was reduced to 9.1%. This reduction in tax rate has opened up the China market for many high-end overseas retailers who sold different products ranging between RMB1,000 and RMB5,000 per unit.

After understanding the above two models, below example illustrates how to calculate the tax when a consumer buys two cans of milk powder worth RMB200 from an overseas online store :

- Personal shipping model: 200*2*13%= RMB52 (US$7.3)

- CBEC shipping model: 200*2*9.1%= RMB36.4 (US$5)

As you can see from the above, the price of the same order may vary depending on the mode used, so you can choose the appropriate mode according to your needs.

3.Summary

China Customs provides an efficient and low-cost way which is CBEC mode. If you want to enter China this way,MyMyPanda may be a good partner. Through this platform, Chinese consumers can shop smoothly in your online shop. MyMyPanda one-stop cross-border e-commerce platform can help you solve cross-border logistics, local payment, tax and customs clearance issues.If you have a question about China cross-border tax, please leave a comment below and our cross-border experts will be more than happy to answer your questions.