More and more brands want to do business in China – the second largest consumer market in the world. China’s middle class population is booming, and their demand for overseas high-quality goods is also growing. In this regard, the Chinese government has introduced many policies to encourage import consumption. The time has come to sell products to China, So which cross-border business model is most suitable for you?

1. China cross-border models

|

Cross-border business model |

Universal Postal Union (UPU) |

Commercial Express (C2C) |

Cross-border E-commerce |

|

Clearance way |

Postal clearance |

Express clearance |

Cross-border E-commerce customs clearance |

|

Type of declaration |

Customs random inspection |

All items are declared to customs |

All items are declared |

|

Recipient information |

Not required |

Photo of ID card required |

ID card number required |

|

Applicable item |

personal belongings |

||

|

Tax model |

Personal Postal Articles’ Tax |

Cross-border e-commerce comprehensive tax |

|

|

Common tax rate |

13% / 20% / 50% |

9.1%/ 17.9% / 23.1% |

|

|

Tax incentives |

Waiver of RMB 50 fee |

Exemption from customs duty; |

|

|

Consumer annual purchase limit |

No limit |

RMB 26,000 |

|

|

Order value limit |

Overseas→ China: RMB 1,000 |

Each single transaction limit |

|

|

Advantages |

Enjoy tax exemption |

Enjoy tax exemption |

Enjoy lower tax rate; |

|

Disadvantages |

Risk of failing customs clearance; Uncertain logistics delivery time |

Higher tax rate than CBEC comprehensive tax |

Every orders are subjected to tax |

2.Personal Postal Articles’ Tax

Overseas brands wants to sell products to China consumers and shipped via UPU or C2C channels, should know the personal postal articles’ tax regulations. This is the import tax levied by China Customs on the articles brought by individuals and mailed into the country. Hence, this model can only be used for personal use and goods with restricted value.

Calculation of personal postal articles’ tax

Tax payable = Dutiable value * Quantity * Tax rate

The dutiable value is not exactly the purchase price of the commodity, but the valuation of the commodity by the Chinese Customs. Only when the difference between the purchase price and dutiable value is large (more than double or less than half), the calculation shall be based on the purchase price of the commodity. If the tax payable is less than RMB 50, consumers don’t have to pay tax, and the customs will release the items immediately.

Tax rate list of common goods:

| Tax Number | Item | Unit | Dutiable value

(RMB) |

Tax rate |

| 01010700 | milk powder | kilogram | 200 | 13% |

| 01020200 | coffee | kilogram | 200 | 13% |

| 04010100 | coat | piece | 300 | 20% |

| 04020100 | cap | piece | 100 | 20% |

| 04020200 | scarves/headscarves | individual | 100 | 20% |

| 04020300 | necktie | individual | 100 | 20% |

| 04020400 | waistband | individual | 100 | 20% |

| 04020500 | gloves | pair | 100 | 20% |

| 05010600 | leather skirt | piece | 1000 | 20% |

| 06020100 | leather shoes | pair | 300 | 20% |

| 06020300 | sneaker | pair | 200 | 20% |

| 07010220 | stem-winder | block | 500 | 20% |

| 09010111 | perfume≥ RMB 10 / ml (gram) | bottle | 300 | 50% |

| 09010112 | perfume< RMB 10 / ml (gram) | bottle | 300 | 20% |

| 09010211 | lipstick≥ RMB 10 / ml (gram) | branch | 150 | 50% |

| 09010212 | lipstick< RMB 10 / ml (gram) | branch | 150 | 20% |

| 09010311 | mascara≥ RMB 10 / ml (gram) | branch | 100 | 50% |

| 09010312 | mascara< RMB 10 / ml (gram) | branch | 100 | 20% |

| 09010341 | eyeshadow≥RMB 10 / ml (gram) | box | 100 | 50% |

| 09010342 | eyeshadow<RMB 10 / ml (gram) | box | 100 | 20% |

| 09010511 | Foundation≥ RMB 10 / g | Box | 200 | 50% |

| 09010512 | foundation<RMB10/g | Box | 200 | 20% |

| 09020110 | Face cleanser | bottle | 100 | 20% |

| 09020120 | makeup remover | bottle | 150 | 20% |

| 11011100 | electric cooker | set | 500 | 20% |

| 11011700 | coffeemaker | set | 4000 | 20% |

| 11021120 | electric hair dryer | set | 200 | 20% |

For example, a Chinese customer purchased 2kg milk powder on e-shop. If UPU / C2C model is adopted, how much is the payable tax?

From the above table, milk powder dutiable value is RMB 200 / kg, and the tax rate is 13%. Therefore, the payable tax can be calculated as follows:

- Case 1: When the price of milk powder is RMB 90/ kg (less than half of the dutiable value), the tax payable is:

90 * 2 * 13% = RMB 23.4 (tax exemption)

- Case 2: When the price of milk powder is RMB 150/ kg, the tax payable is:

200 * 2 * 13% = RMB 52

- Case 3: When the price of milk powder is RMB 400/ kg (2 times higher than the dutiable price), the tax payable is:

400 * 2 * 13% = RMB 104

3.Cross-border e-commerce(CBEC)comprehensive tax

The CBEC comprehensive tax is a preferential tax policy set by the Chinese government for cross-border e-commerce. In this mode, you can sell products directly to China consumers by cross-border direct mail and bonded warehouse.

Calculation of CBEC comprehensive tax

Tax payable = Purchase price * Quantity * Tax rate

If the order amount on cross-border e-commerce platform does not exceed RMB 5,000 and individual annual limit of RMB 26,000, the tariff rate is 0%. The import value-added tax and consumption tax will be levied at 70% of the tax payable.

CBEC comprehensive tax rate for common goods:

| Item | CBEC comprehensive tax rate |

| milk powder | 9.1% |

| paper diaper | 9.1% |

| health products | 9.1% |

| chocolate | 9.1% |

| coffee | 9.1% |

| beer | 9.1% |

| Face mask <RMB 15 / piece | 9.1% |

| Skin care products <RMB 10 / ml | 9.1% |

| Cosmetics / makeup <RMB 10 / ml | 9.1% |

| Perfume <RMB 10 / ml | 9.1% |

| shampoo | 9.1% |

| body wash | 9.1% |

| toothpaste | 9.1% |

| Mobile phones, tablets | 9.1% |

| Headphones, speakers | 9.1% |

| Women’s wear, men’s wear, underwear | 9.1% |

| Bags, wallets, | 9.1% |

| Watch with a price of <RMB 10,000 | 9.1% |

| shoes | 9.1% |

| belt | 9.1% |

| scarf | 9.1% |

| kitchen ware | 9.1% |

| wine | 17.9% |

| Golf ball | 17.9% |

| Face Mask≥RMB 15 / piece | 23.1% |

| Skin care products≥RMB 10 / ml | 23.1% |

| Cosmetics / makeup≥RMB 10 / ml | 23.1% |

| Perfume≥RMB 10 / ml | 23.1% |

| Watch with a price of ≥RMB 10,000 | 28.9% |

For example, if a Chinese customer purchases 2kg milk powder on your e-shop, if CBEC model is adopted, how much tax should he pay?

From the above list, the CBEC comprehensive tax rate of milk powder is 9.1%,Therefore, the payable tax can be calculated as follows:

- Case1: When the price of milk powder is RMB 90 / kg, the tax payable is:

90 * 2 * 9.1% = RMB 16.4

( For UPU / C2C mode, tax is waived for any amount less than RMB 50 )

- Case 2: When the price of milk powder is RMB 150/ kg, the tax payable is:

150 * 2 * 9.1% = RMB 27.3

(Compared to UPU / C2C, where the tax is RMB 52, CBEC model will save RMB 24.70)

- Case 3: When the price of milk powder is RMB 400 / kg, the tax payable is:

400 * 2 * 9.1% = RMB 72.80

(Compared to UPU/C2C, where the tax is RMB104, CBEC model will save RMB 31.20)

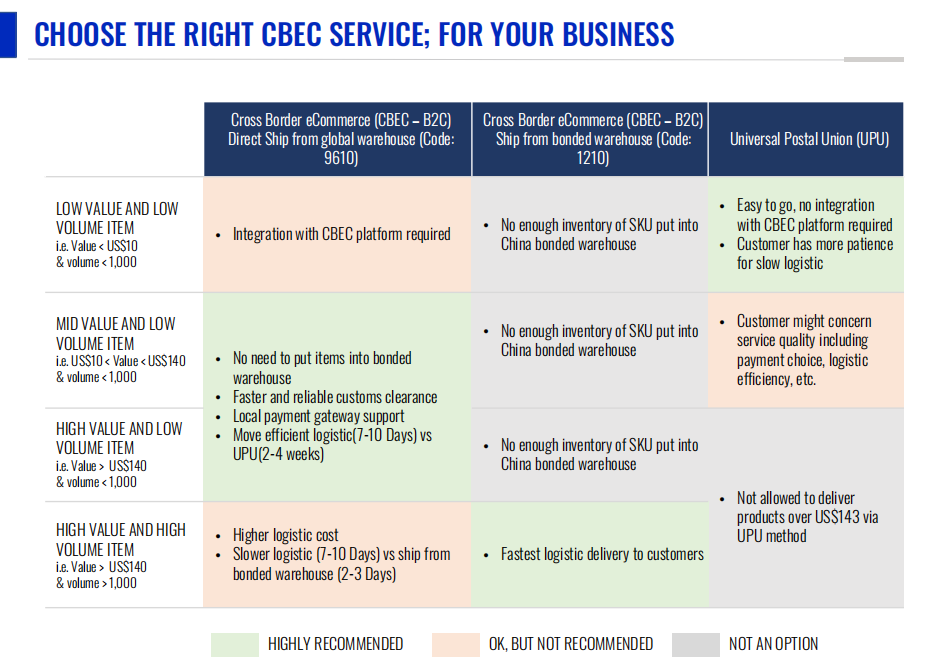

4.How to choose the right cross-border model?

Sell products to China consumers can be complicated and managing the customs administrative process can add to the challenges. Overseas merchants need to understand how taxes are calculated based commodity type, price, order volume and more. However, the benefits and cost effectiveness of using China CBEC is a clear winner. What’s more, it provides a better shopping experience for customers with local payments and faster delivery.

If you have questions about selecting cross-border business model,do leave a message below the article or schedule an appointment to speak with our China CBEC experts.