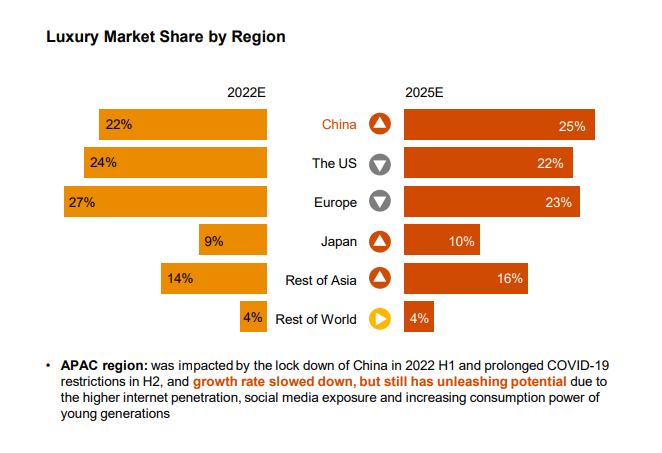

Recently, PWC released a report saying that with the gradual recovery of travel and social interaction, the global luxury goods market is recovering, even exceeding the pre-epidemic level.

China will lead the international luxury consumption market by 2025

In 2022, the United States and Europe led the development of the global luxury goods market. However, with the lifting of epidemic control in China and the increasing consumption power of the younger generation, the luxury goods market in China is expected to reach $119 billion (816 billion yuan) by 2025, accounting for about 25% of the market share.

PWC points to several factors influencing luxury consumption in China, with high net worth individuals being key, who value exclusivity, scarcity, uniqueness and mystery.

Luxury sales soar in China during Valentine’s Day

Just after Valentine’s Day on February 14th, JD.COM, the mainstream online shopping platform in China, released the latest consumption data: from February 8th to February 13th, the turnover of nearly 200 luxury brands increased by more than 100% YOY, and the overall turnover of top luxury brands led by LV increased by more than 5 times YOY. The turnover of Roger Viver and CELINE increased by more than 10 times YOY becoming the fastest-growing top luxury brand during Valentine’s Day.

Geographically, Beijing, Shanghai and Jiangsu have the highest turnover of luxury brands. Couples’ suits, watches and luxury brand gift boxes are the first choice for consumers to express their love during Valentine’s Day. Among them, LOLA ROSE watch gift box, Ferragamo cowhide belt and Longines women’s watch rank TOP 3 in the sales of luxury goods in JD.COM.

China has always been a key market for luxury brands, and a number of luxury groups, including LVMH and Kering, have expressed optimism about the Chinese market. According to Kering Group, Gucci will make efforts to revitalize the Chinese market next. In order to gain a larger market share, the brand will actively participate in major holiday marketing campaigns to meet the preferences of Chinese consumers. For example, Cartier has launched a special Chinese version of its Santos-Dumont watch collection, and Loewe’s limited edition handbag this year not only references Chinese porcelain in its color scheme, but also has a custom ceramic bunny accessory.

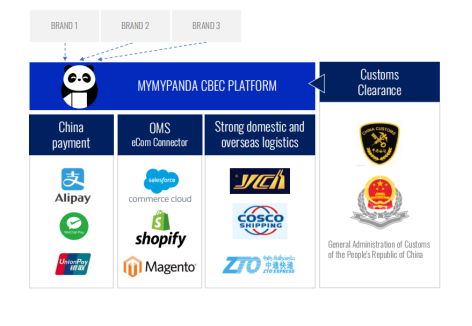

Expand your business through cross-border e-commerce in China

In MyMyPanda’s view, driven by multiple favorable factors, China’s high-end consumer goods market will see greater development opportunities in 2023. However, it is not easy for international brands to enter China, as they need to break through various barriers such as language, ecology and regulations. The good news is that cross-border e-commerce is a lightweight test for international brands that have not yet entered the Chinese market, without the need to build a local team in mainland China or complete a complicated registration process. You can talk to our experts to get strategies for entering China through cross-border e-commerce. MyMyPanda specializes in developing markets and increasing sales for international brands through e-commerce platforms, influencer marketing, social media advertising and more.