The consumption of health supplements is often strongly linked to the level of consumption of local residents. In recent years, the expansion of the middle class population and awareness for healthy living has led to the flourish of health supplements consumption in China market. In the post-pandemic era, with the increasing pressure of an aging society, the health supplements market is expected to maintain a high level of growth. According to data released by Euromonitor, it is estimated that the scale of China’s health supplements market will reach ¥436.6 billion by 2025.

Four Key Health supplements Categories

Vitamins and Dietary Supplements (VDS)

VDS are products that contain nutrients such as vitamins, minerals designed to make up for any nutrients that may be lacking in a person’s daily diet. This category of supplements makes up the largest proportion in the health supplements industry and has a wide consumer base. According to a survey conducted by Rakuten Insight in March 2022, 59% of respondents in mainland China reported having taken dietary supplements. A typical consumer scenario is the use of supplements for infants and pre-natal pregnancy. Statistics show that 94.7% of pregnant women consume health supplements during pregnancy, with folic acid, milk powder, and complex vitamin tablets being the most popular. The implementation of China’s three-child policy is expected to bring more demand to the maternal and child health supplement market. Since the outbreak of the pandemic, public awareness for immune system enhancement has increased. This has led to fierce competition in the children’s probiotics business. The new generation of Chinese parents focus on scientific child-rearing and proactively purchase dietary supplements for their children, such as probiotics and vitamins, to enhance their immune systems.

China mainly imports dietary supplements from the United States, Australia, and Japan, each with their own advantages. The main categories of supplements imported from the United States are vitamins, glucosamine and coenzyme Q10 products. The main categories of supplements imported from Australia are fish oil, grape seed, and lactoferrin.

Herbal/Traditional Products

These supplements mainly use traditional Chinese medicine ingredients such as ginseng, astragalus, angelica, and goji berries or other natural plant components as the source. Historically, China has a tradition of “food and medicine having the same origin”, so these ingredients are believed by Chinese people to have functions such as enhancing physical fitness, improving health, and delaying aging.

In modern economy, young Chinese professionals are facing enormous work pressure, such as lack of sleep or difficulty in falling asleep, long-term eye fatigue caused by computer screens, and high psychological stress. Although young people can improve their health status through exercise or adjusting their schedules, most of them still choose health supplements because it’s simple and more effective. Therefore, China’s post-90s and Generation Z populations are considered to be the driving force behind the sales of health supplements.

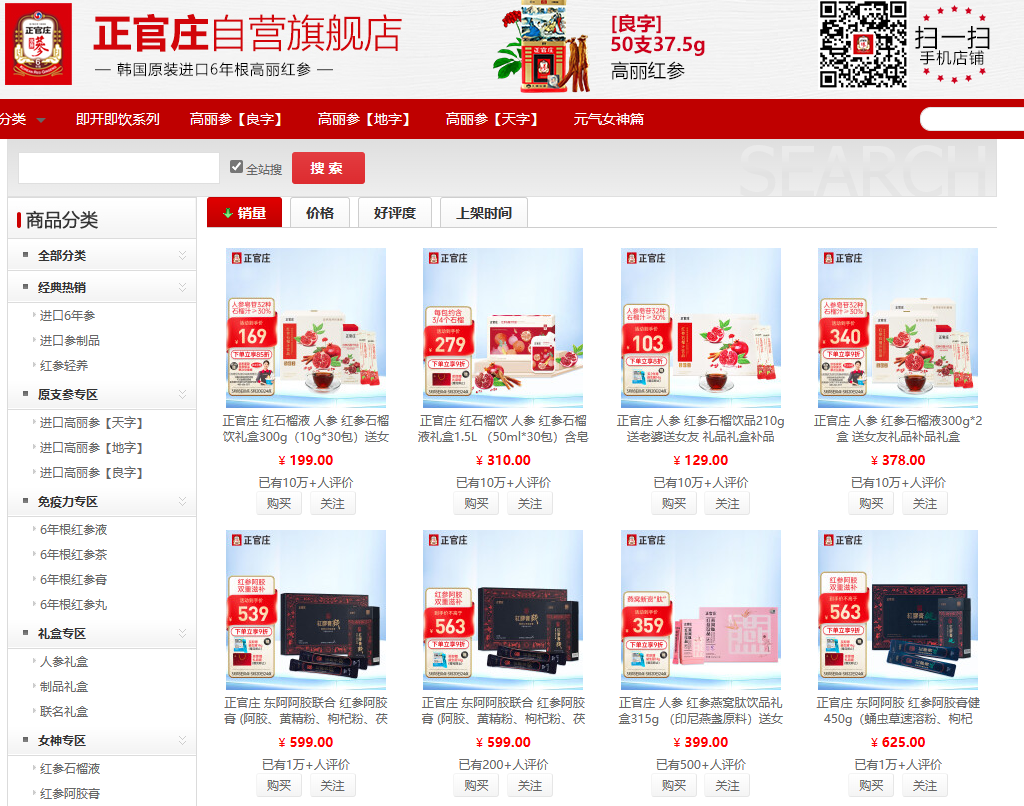

To adapt to the fast-paced work, young professionals will incorporate health supplements to balance their lives. The first consideration when purchasing health supplements is the source of ingredients and safety of use. Therefore, green, organic, and natural health tea drinks, as well as small packaged and convenient bird’s nest drinks, are popular among young Chinese people. Unlike men, women prefer health supplements in the form of snacks and are more willing to pay for interesting and avant-garde packaging. For example, internationally recognized brands such as Korea’s Zhengguanzhuang ginseng drink and Indonesia’s instant bird’s nest have achieved astonishing growth on Chinese e-commerce platforms.

Sports Nutrition

Sports nutrition refers to specialized nutritional supplements designed for athletes and fitness enthusiasts, which typically include protein powders, amino acids, energy supplements, vitamins, and minerals. In recent years, the number of people in China who regularly exercise has been increasing. They consider exercise as an important part of their daily lives and hope to maintain a good body shape and emotional state by choosing suitable exercises like yoga, bodybuilding, jogging, or ball games. In addition to regular exercise, consumers consider taking sports nutrition supplements to achieve greater results fast. As sports-related supplements become more specialized and segmented, products that can enhance exercise performance, such as testosterone supplements, are also becoming increasingly popular, in addition to protein powder.

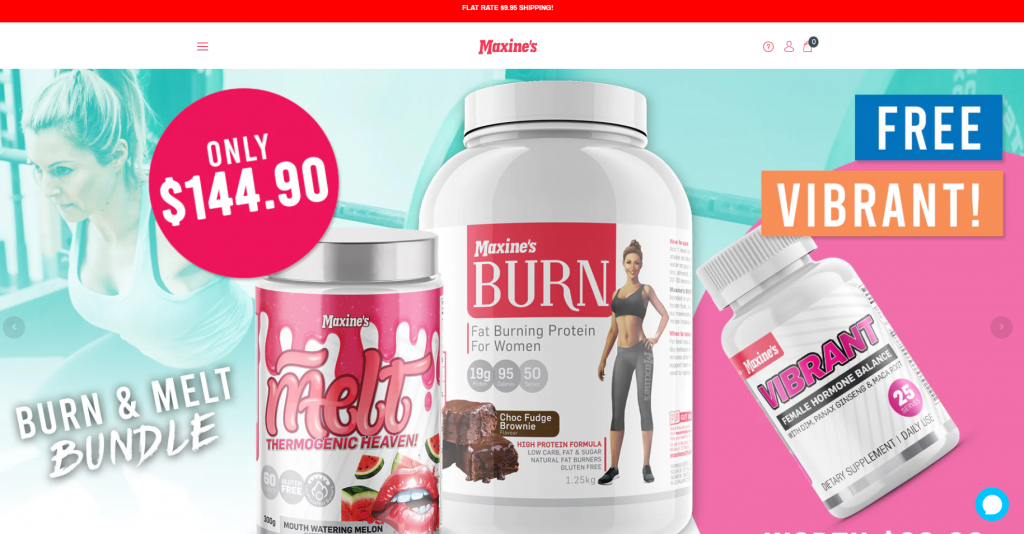

Brands should note that the needs of men and women are essentially different when purchasing sports supplements. For example, when purchasing protein powder, men tend to prefer high-protein products, which improve body function, muscle growth and repair. Increase exercise performance are the main reasons for their purchase of sports nutrition. Women tend to choose composite products, while also paying more attention to the taste and ingredients of the product. In recent years, protein powders such as Maxines from Australia have become very popular among women in China. They contain ingredients like L-carnitine and other weight loss components that is deem attractive for women who focus on weight loss and body shaping.

Weight management

Weight management products typically include various types of nutritional supplements, meal replacements, and more, aimed at helping people lose or maintain weight by controlling calorie intake and promoting metabolism. The obesity rate in China has been steadily increasing over the past few years; and now exceeding 20% of the population. Influenced by this trend, more and more people are paying attention to weight loss. They are willing to spend more money on high-quality and effective weight management products.

Currently, meal replacement shakes with ice cream-like flavors are widely popular on e-commerce platforms in China. These products can replace part or all of a regular meal, control calorie intake, and there are also fiber-based products like Japan’s “aojiru,” which can help people control appetite, increase satiety, and reduce the amount of food intake to achieve their weight loss goals.

China consumers prefer trustworthy international brands

According to a study by the Chinese Nutrition Society, nearly 60% of participants reported purchasing imported health supplements because they are perceived to be safer, more effective, and better quality. Hence, overseas health supplements are trusted by Chinese people especially coming from Australia, New Zealand, Canada, and the United States. Although imported products may be more expensive than domestic substitutes due to tariffs and other fees, Chinese consumers are still willing to pay a premium for them. Therefore many international brands are actively expanding into the Chinese market. For instance, Canada’s Jamieson, has appointed an exclusive agent in China, and Germany’s Sunlife, is partnering with mainland enterprises to enter the Chinese market.

China’s best selling consumer brand – Swisse

Australian leading supplement, Swisse, has achieved tremendous success in China mainly through online retail channels. Currently, the Swisse product line includes multiple series such as beauty nutrition, family nutrition, and maternal and child nutrition. In addition, Swisse has launched multiple health supplements targeting different groups, including men’s and women’s multivitamin tablets, and adult functional liver-protecting drinks.

Prior to entering the Chinese market, 40% of Swisse’s revenue came from Chinese consumers, thanks to the rise of cross-border e-commerce in 2008. Australian Chinese and Chinese international students successfully made Swisse a popular brand through the formation of purchasing agents. In 2016, Swisse expanded its sales channels in China through official cooperation with cross-border e-commerce platforms such as Tmall International and JD International. In addition to e-commerce platforms, Swisse has adopted a more localized marketing approach by not only hiring well-known Chinese actress Dilireba as its brand ambassador, but also actively conducting various topic-based marketing on popular social media platforms among young people, such as TikTok and Little Red Book. These marketing strategies quickly made Swisse a successful brand in the Chinese market, with sales exceeding ¥2 billion, making it one of the leading brands in China’s health supplement market.

How to sell health supplements direct to consumers in China?

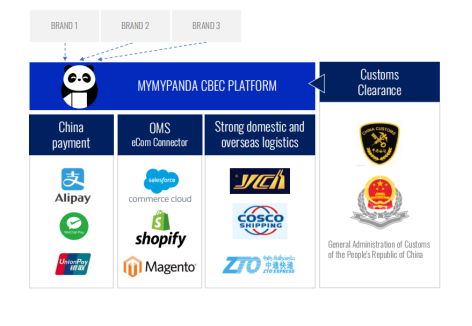

In MyMyPanda’s view, the Chinese health supplement market will encounter greater development opportunities in 2023, driven by multiple favorable factors. It is widely known that the success of any brand cannot be fully replicated, but Swisse’s success story in entering the Chinese market proves the feasibility of CBEC channels. Without CBEC, health supplement brands like Swisse would often face regulation in terms of ingredients, brand, and hygiene permits when entering the Chinese market. However, their strategy to use CBEC has help them meet the existing high health standards and technical requirements. Hence, they can sell effectively in China through e-commerce channels without the need to register with more regulatory agencies.

Compared with traditional trade that requires substantial initial investment and physical retail presence, CBEC offers an efficient, fast, and low-cost sales method for overseas brands in China. However, international brands still need to handle cross-border payments, logistics, customs clearance, and other issues. The good news is that MyMyPanda has obtained approval from the Chinese government and has the qualification to serve as a CBEC service provider for overseas brands. MyMyPanda is a one-stop service to help brands enter the China CBEC market and build your business through influencer marketing, and social media advertising. Talk to our experts to understand the different strategies you can adopt to become a successful health brand in the Chinese market.